Over the past few years—wink, wink COVID—the industry has seen a rise in purchasing activity between plumbing and HVAC companies and private equity firms and other outside influences—coming in and gobbling up already successful contracting shops with a message of making them better. Sure, it’s a smart exit strategy as well for those looking to Read more

private equity

Over the past few years—wink, wink COVID—the industry has seen a rise in purchasing activity between plumbing and HVAC companies and private equity firms and other outside influences—coming in and gobbling up already successful contracting shops with a message of making them better. Sure, it’s a smart exit strategy as well for those looking to hang up the wrenches.

But why the flurry of activity now? “What we’ve seen from COVID is that the trades are pandemic-proof and to some extent recession proof. When money gets tight, consumers may hold off on that new car, going out to eat, but when that water heater goes out, it’s a necessity,” says Dan Foley, Foley Mechanical, Lorton, Va.

Foley continues, “Artificial Intelligence (AI) will never be able to take over this industry. You will always need someone to walk into someone’s home and make a repair, and that’s not easy to do. It’s the technician’s skill that AI cannot replace.”

According to Mike Prencavage Jr., president/owner, The Family Plumber, Los Alamitos, Calif., president, PHCC ORSB, director, PHCC National Business Development, “Working on margins is crucial for any business to succeed; however, in the plumbing industry most companies aren’t struggling with tight margins to turn a profit.”

As an example, Prencavage Jr. says restaurants and bars can stand to lose greatly if more than two ounces of alcohol is poured into any drink or if larger than accounted for portions of food are served on any plate. These private equity firms have seen that plumbing companies have a greater amount of sold labor income per invoice that can offset losses on jobs allowing for much wider margins to run a profitable business.

“Private equity firms are also looking to the future of renewable energy. With the electrification of the nation soon to be at every state’s doorstep, government grant funding has already become available to plumbing companies who are leading the way by installing energy efficient products. These grant programs. combined with the opportunity to capitalize on wider margins, are creating a buzz of interest from private equity groups to get more involved in the plumbing industry sector,” says Prencavage Jr.

Speaking of grants, on a national level, the Infrastructure Bill and Inflation Reduction Act, are ripe for the taking, if eligible.

On the flipside, private equity firms offer contractors security, not only monetarily, but though the expansion of their reach and service offerings across their respective regions, expand evolving customer bases and refine overall strategic growth initiatives.

Just last month, Grove Mountain Partners—a private equity firm investing in lower, middle market home service companies and specialty business service companies—announced the sale of Unique Indoor Comfort Holdings LLC to Ace Hardware. Nate Kukla, CEO, and the entire management team, including the brand presidents, will continue to lead the company as it embarks on its next growth phase.

Grove Mountain brought together 12 independent service-providing businesses, beginning in June 2021, with the acquisition of three related companies: Moncrief Heating & Air, Unique Indoor Comfort of Philadelphia, and Werley Heating & Air. It added nine other companies in the Eastern region of the U.S., including Clay’s Climate Control, Detmer & Sons, Canella Heating & Air, A-Total Plumbing, All Phase Electrical, Dick Hill & Son, Carolina Custom, Rye Heating and Air, and Jackson Plumbing and Heating & Air.

“We are grateful for our partnership with Grove Mountain and are proud of what we have built and accomplished,” said Nate Kukla, CEO. “Now, we are excited to be part of the Ace team which will allow us to leverage their combined financial and operational capabilities and expertise. Since day one, Unique has been passionately dedicated to an employee-centric, high-integrity, and customer-focused culture. Ace shares in our mission and values and brings a plethora of resources to allow us to continue and grow the business.”

Also, this month, Auctus Capital Partners—a leading financial services and investment banking firm focused exclusively on creating value for the lower middle market, which specialize in merger and acquisition advisory, institutional private placements of debt and equity, financial restructuring, valuation, and strategic consulting—announced its role as exclusive advisor to The Precision Group and its affiliated entities, supporting the environmental and infrastructure services leader in completing a majority recapitalization by PowerVac, a Pillsman Partners LLC and Peninsula Capital Partners, LLC portfolio company.

Also, this month, Auctus Capital Partners—a leading financial services and investment banking firm focused exclusively on creating value for the lower middle market, which specialize in merger and acquisition advisory, institutional private placements of debt and equity, financial restructuring, valuation, and strategic consulting—announced its role as exclusive advisor to The Precision Group and its affiliated entities, supporting the environmental and infrastructure services leader in completing a majority recapitalization by PowerVac, a Pillsman Partners LLC and Peninsula Capital Partners, LLC portfolio company.

The Precision Group is comprised of three separate yet complementary companies that serve a diverse array of commercial, industrial, and municipal customers. Founded in 1992, Precision Industrial Maintenance, Inc. provides environmental remediation, industrial cleaning services, hazardous and non-hazardous waste transport and disposal, and other industrial waste services. Martin Environmental Services, Inc. was acquired by Precision Group in 2002, adding new services in asbestos and lead abatement, and disposal services. Precision Trenchless, LLC was formed in 2013 to focus on environmentally-friendly pipe rehabilitation using less disruptive technologies, such as UV-Cured and other Cured-in-Place Pipe Lining (CIPP) methods, potable water line rehab to minimize air, water and soil pollution and support advanced monitoring services.

The Precision Group is comprised of three separate yet complementary companies that serve a diverse array of commercial, industrial, and municipal customers. Founded in 1992, Precision Industrial Maintenance, Inc. provides environmental remediation, industrial cleaning services, hazardous and non-hazardous waste transport and disposal, and other industrial waste services. Martin Environmental Services, Inc. was acquired by Precision Group in 2002, adding new services in asbestos and lead abatement, and disposal services. Precision Trenchless, LLC was formed in 2013 to focus on environmentally-friendly pipe rehabilitation using less disruptive technologies, such as UV-Cured and other Cured-in-Place Pipe Lining (CIPP) methods, potable water line rehab to minimize air, water and soil pollution and support advanced monitoring services.

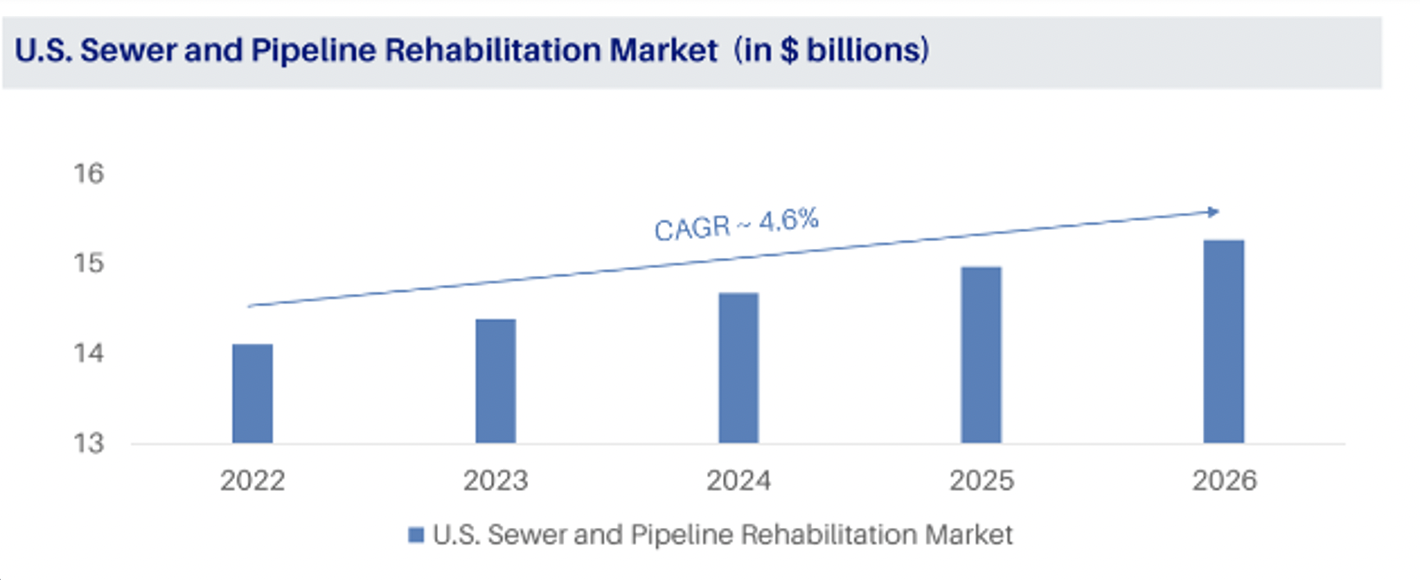

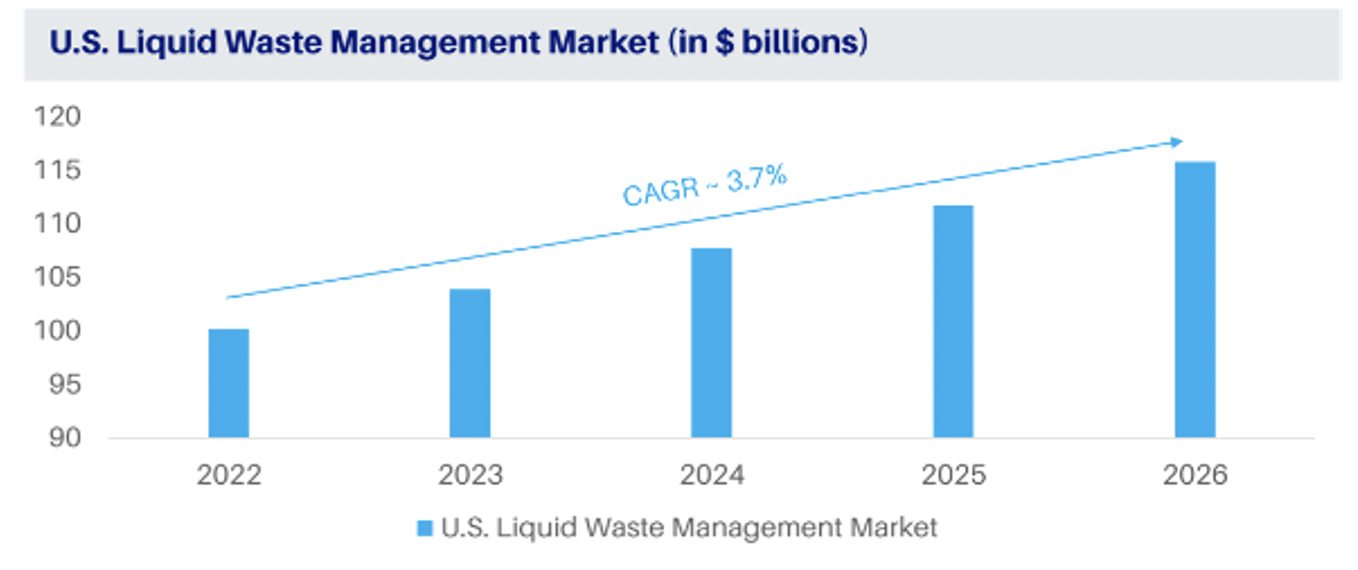

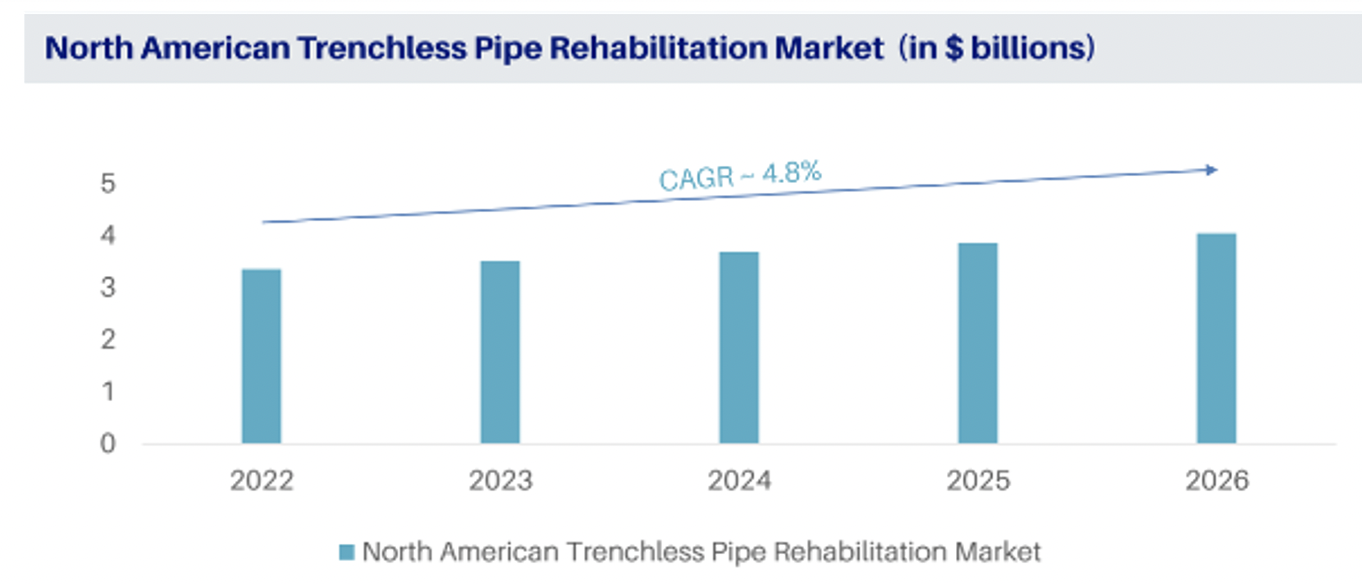

The group of companies operate as a unified provider of services to several broad regional markets with strong projected growth through 2026 — including the sewer and pipeline rehabilitation market with a compound annual growth rate (CAGR) of 4.6%, as well as trenchless pipe rehabilitation (4.8% CAGR), and liquid waste management (3.7% CAGR).

The group of companies operate as a unified provider of services to several broad regional markets with strong projected growth through 2026 — including the sewer and pipeline rehabilitation market with a compound annual growth rate (CAGR) of 4.6%, as well as trenchless pipe rehabilitation (4.8% CAGR), and liquid waste management (3.7% CAGR).

“Underpinned by significant government support for the repair of aging infrastructure, pipeline rehabilitation and wastewater management services are seeing record investment. In addition, an ever-growing awareness of ESG issues has been driving strong investor demand,” says Muhammed Azfar, CEO and managing partner, Auctus.

More to come on this topic.