It’s that time of year again where media, prognosticators and media prognosticators try to look into the immediate future to predict, and make sense of, the short-term economy. And, yes, even in this uncertain climate.

According to the Air-Conditioning, Heating & Refrigeration Institute (AHRI), U.S. shipments of residential gas storage water heaters for January 2021 increased 3.4 percent to 397,342 units, up from 384,213 units shipped in January 2020. Residential electric storage water heater shipment saw a 2.4 percent increase in January 2021 to 395,640 units, up from 386,291 units shipped in January 2020.

Commercial gas storage water heater shipments decreased 7.8 percent in January 2021 to 6,642 units, down from 7,207 units shipped in January 2020. Commercial electric storage water heater shipments decreased 7 percent in January 2021 to 11,737 units, down from 12,626 units shipped in January 2020.

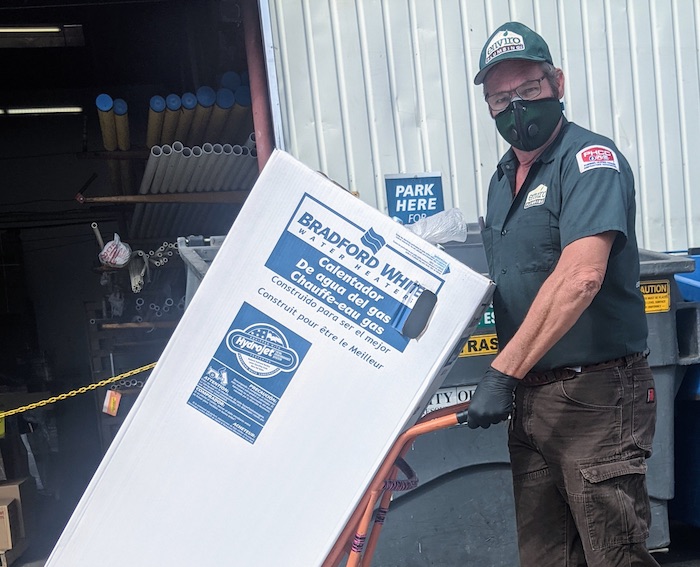

Having said all of that, Mechanical Hub decided to go right to the source to get an up-close sense of how the market is faring. We continue our Forecast Series with Bruce Carnevale, president & CEO, Bradford White.

Having said all of that, Mechanical Hub decided to go right to the source to get an up-close sense of how the market is faring. We continue our Forecast Series with Bruce Carnevale, president & CEO, Bradford White.

MH: When it comes to 2021 industry forecasts, the most resonant word I hear is optimistic. That word can become hollow if it doesn’t have any substance backing it up. I’ve read reports that residential service repair and remodel may remain constant with a slight increase in early 2021. What does the short-term economy look like as it relates to BW?

CARNEVALE: In a word, challenging. While demand for our core residential products remains strong, material and labor costs have risen substantially. Labor availability for manufacturers is still a significant problem and has been exacerbated by COVID-19 complications and government policies. Steel prices are at or near all time highs, and supply is becoming an issue for some manufacturers. These factors lead to longer lead times, higher prices to the end user, and product shortages.

We know intuitively that the “nesting” effect has led to increased demand because household appliances are being use much more that they normally would be. There is no good data on magnitude of the increased demand, nor how long it will last.

Commercial demand has recovered slightly, but with commercial businesses still in some state of shutdown in much of the country, we don’t see that segment starting to recover until the second half of 2021. It is unlikely that the commercial segment will fully recover to pre-pandemic levels until after 2022 because so many businesses will permanently shut down as a result of the pandemic-forced shutdowns.

MH: What are some indicators you look at to determine trends, movements, etc.?

MH: What are some indicators you look at to determine trends, movements, etc.?

CARNEVALE: We look at traditional indicators such as housing starts re-sales, mortgage rates, CPI, consumer confidence, manufacturing output and inventories, unemployment rates, etc. Several years ago, we incorporated student loan debt into our analyses since it has such a significant impact on first time homebuyers. Additionally, we closely follow regulations and all levels and social preferences to determine their impact on product trends.

MH: I read somewhere that at the rate the U.S. is distributing the vaccine, we should be back to “normal” by 2024. Perhaps that’s a bit overly dramatic, but how does (has) BW positioned itself from the “fallout” of COVID-19?

The honest answer is that nobody really knows when we will be back to normal. Even after we are, there will be lasting effects from the pandemic. We are following the data and trends closely and adjusting our strategy accordingly. We expect some pre-pandemic trends to change significantly. For example, the trend toward urbanization will change as more people are able to work from home. This leads us to believe that the housing new construction will shift away from multifamily towards single family as people can move further out from cities.

Additionally, we are solidifying supply chain and strengthening our contingency plans, further developing our own work force, and investing significantly in R&D to bring relevant, innovative products to the post-pandemic market.

MH: Is the only certainty heading into early 2021 uncertainty? How do you forecast and budget for such uncertainty? (Or is it fairly certain at this point during the pandemic?)

CARNEVALE: Uncertainty has made forecasting for 2021 is as much art as it is science. We used an immense amount of data, both historical and forward-looking, and applied significantly more assumptions than we typically would. We also included insights derived from some original research projects we commissioned.

MH: Without getting overly political, does a change at the presidential level (and congress) change the outlook for your company, if at all? (Infrastructure, regulations, green energy initiatives, etc.)

CARNEVALE: Yes. It is no secret that the Biden administration will have a very different policy positions than the Trump administration. Some of the expected changes may be helpful, and others will present challenges. Infrastructure legislation, for example, will be good for our industry. We know there will be a focus on green energy initiatives, and that too can be good for our industry if they are thoughtfully applied. The regulatory environment will become more challenging, but we are hopeful that the new administration will partner with manufacturers in developing new regulations.