NIBCO’s Wrot Racer® C8 Corvette kicks off its tour at AHR Expo 2022 before visiting qualified distributors throughout the United States to celebrate the introduction of Wrot Racer push fittings. NIBCO INC. announces its Wrot Racer® “Start Me Up” promotion to celebrate its next generation of push fittings that it recently launched. The multi-faceted promotion centers on Read more

PEX

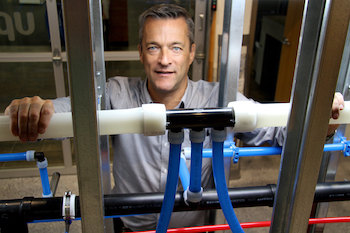

NIBCO’s Wrot Racer® C8 Corvette kicks off its tour at AHR Expo 2022 before visiting qualified distributors throughout the United States to celebrate the introduction of Wrot Racer push fittings.

NIBCO INC. announces its Wrot Racer® “Start Me Up” promotion to celebrate its next generation of push fittings that it recently launched. The multi-faceted promotion centers on the Wrot Racer C8 Corvette that will tour the U.S., making stops at distributor locations that have qualified.

The “Start Me Up” promotion provides a quick and easy way for distributors to take on immediate inventory of the new Wrot Racer copper push fittings. Distributors who meet the minimum stocking order requirement will receive a free marketing kit that includes POP merchandising.

NIBCO’s Wrot Racer Corvette began its tour at AHR Expo in Las Vegas on January 31, before moving to the West Coast, making various stops along the way, including Phoenix and Los Angeles. The “Start Me Up” promotion runs through 2022.

“We’re excited for our Wrot Racer Corvette to head out on the road to visit qualifying distributors across the U.S.,” said Ashley Martin, executive vice president, NIBCO INC. “This is a great opportunity for distributors to create additional coverage for their businesses and for everyone attending to have fun!”

Introduced in 2021, Wrot Racer push fittings are a line of premium copper push fittings that are engineered to join copper, CPVC-CTS, PEX and PE-RT (with stiffeners) for easy transition between piping systems. With a patented fitting design, installations are easily made within seconds.

Wrot Racer push fittings are made with 99.9 percent pure wrot copper. Naturally lead free, the fittings feature antimicrobial properties and are dezincification resistant, providing for safe, clean drinking water connections for both residential and commercial applications.

Available in 1/2″ to 1″ sizes, the lightweight and compact Wrot Racer fittings are able to be installed wet or dry and can handle applications up to 200 psi and 200 degrees. The new fittings feature stainless steel gripper rings to ensure a secure connection. Wrot Racer fittings are ideal for tight-space installations and can also be removed and reused, avoiding wasted materials.

To learn more about how NIBCO’s Wrot Racer Corvette can make an appearance, contact your local NIBCO sales representative, visit nibco.com/wrotracer/ or email Customerservice@nibco.com. Contractors should contact their local distributor to see if it is on the Wrot Racer tour list.

As companies continue to explore how to safely return office staff in a post-pandemic environment, Uponor North America is giving its office employees the flexibility to work their own way. The Apple Valley, Minn.-based PEX pipe manufacturer is introducing Flexible First, an employee-centric model that empowers staff to choose the working pattern that works best Read more

As companies continue to explore how to safely return office staff in a post-pandemic environment, Uponor North America is giving its office employees the flexibility to work their own way. The Apple Valley, Minn.-based PEX pipe manufacturer is introducing Flexible First, an employee-centric model that empowers staff to choose the working pattern that works best for them.

Flexible First offers three ways for office staff to work, called “personas”:

- Resident – employees working in an Uponor office at least four days a week.

- Hybrid – employees who may come into the office up to three days per week.

- Remote – employees that work from locations that aren’t near an Uponor office.

The company built its Flexible First model after more than 100 hours of employee-led focus groups, panel discussions, and the development of a culture team. Using this data, the company established a multi-phased plan for introducing the future of office work at the company.

“As we plan for our post-pandemic world, it is essential to evolve with the changing times that are defining what the future of work looks like,” said Jen Hauschildt, vice president, Human Resources, Uponor North America.

“For most people, going back to a traditional work environment doesn’t make sense. Employees want more flexibility. By working with our employees to define a new way of working that fits for them and for our business, we are showing our strong commitment to both the employee and customer experience.”

Since March of 2020, the majority of Uponor office-based employees have been working remote and have demonstrated a high level of productivity. The company has determined that Flexible First will be its “new” normal for work indefinitely.

“No matter what our working environment looks like, Uponor employees embrace our core values of Connect, Build and Inspire. These values define and motivate how we work with each other, our customers, and our communities,” added Bill Gray, president, Uponor North America.

Flexible First goes into effect in early 2022. Uponor is planning to introduce a redesigned office space in late 2022/early 2023 that will feature “neighborhoods,” or shared spaces for functional teams to collaborate while in the office. Hybrid employees, including leaders, will reserve a hoteling workspace through a scheduling system for the days they plan to work onsite, rather than having a dedicated workspace. The company has also developed an intranet site that provides resources to help guide employees with this new way of working.

“Implementing a Flexible First work approach is the right thing for us to do to deliver a great employee experience, retain and recruit key talent, and keep Uponor moving forward into the future,” added Hauschildt.

Viega Works online training also will continue. Broomfield, Colo. — Viega LLC will reopen its seminar centers in Colorado and New Hampshire on Aug. 1. The centers had been closed since March 2020 due to COVID-19. Viega is reopening them with new safety measures in place, including limiting class size, cleaning stations and mask requirements Read more

Viega Works online training also will continue.

Broomfield, Colo. — Viega LLC will reopen its seminar centers in Colorado and New Hampshire on Aug. 1.

The centers had been closed since March 2020 due to COVID-19. Viega is reopening them with new safety measures in place, including limiting class size, cleaning stations and mask requirements when appropriate.

“We’re excited to reopen and welcome back our customers, contractors and distributors,” said Jason McKinnon, director oftechnical services. “We moved training online during the pandemic and that’s been successful, but it’s going to be great to work in-person again with people.”

The seminar centers are located at Viega LLC headquarters in Broomfield, Colo., and in Nashua, N.H. Each features classrooms, hand-on workshops and interactive learning displays. Viega offers courses in a variety of subjects, including pressing, design and installation, and each course is customizable to meet the needs of our customers.

In response to customer demand during the lockdown, the company created Viega Works, online sessions largely limited to single companies. These programs, which can be as short as 30 minutes, are custom designed to cover the topics customers request.

“Customers like Viega Works because it’s fast and affordable and gives them the exact information they need without requiring travel or a major time commitment,” McKinnon said. “With the reopening of our seminar centers we offer even more opportunities to engage with our technical consultants than ever before. Customers can attend in-person at one of our seminar centers or contact us to set up a unique virtual experience with content specific to their team. No matter where or how you want to connect with our experts, we will make it easy and valuable for you and your organization.”

With the new normal brought about by the global pandemic, high-performance building is now focusing on the safety of occupants. This is especially true for healthcare buildings. So now, in addition to ensuring the systems you design and install not only perform reliably and meet project schedules and budgets, you also must ensure they can Read more

With the new normal brought about by the global pandemic, high-performance building is now focusing on the safety of occupants. This is especially true for healthcare buildings. So now, in addition to ensuring the systems you design and install not only perform reliably and meet project schedules and budgets, you also must ensure they can support a superior indoor environment. How can contractors meet these new demands while also staying efficient and profitable in every project? Start by looking at the piping materials.

A domestic water system has the responsibility of bringing water from the main source and distributing it throughout the building. When that water is running throughout all the piping, it has the potential to pick up various contaminants depending on the type of system it is running through.

For example, copper, brass, and steel systems can corrode and experience scale buildup over time. That corrosion and scale buildup can impact the drinking water in a system — affecting everything from taste and odor to even bacterial formation.

Other piping systems, such as CPVC, use glues, cements and other chemicals to join the pipe to the fittings. These chemicals are not organic in nature and have the potential to pose risk if they seep into the drinking water system.

The safest material for drinking water requires a durable system that is immune to corrosion and scale buildup and does not use chemicals for joining purposes. This is why PEX is quickly becoming the professionals’ choice for commercial domestic water piping projects.

PEX, a flexible, durable, polymer piping product, has been used successfully in homes and businesses for decades. It naturally resists corrosion and scale buildup and offers several different joining methods, all of which do not use chemicals — or open flame.

Best of all, because PEX is flexible, it greatly reduces the amount of connections needed in a system. This gives you the benefit of a high-performing, durable, long-lasting solution that also helps you with labor time and installation costs.

To learn more about the different PEX piping solutions available for healthcare projects, visit uponor-usa.com/healthcare.

Mechanical Hub continues its series of exclusive Q & A sessions with industry leaders and players to get their views on the future, and living in a COVID world, and an insight into the market in 2021. The American Supply Association released its annual sales report for 2020 and the ASA Pulse sales report shows Read more

Mechanical Hub continues its series of exclusive Q & A sessions with industry leaders and players to get their views on the future, and living in a COVID world, and an insight into the market in 2021.

The American Supply Association released its annual sales report for 2020 and the ASA Pulse sales report shows member distributor respondents enjoyed an average sales growth of 4.4% and a median growth of 6% during the fourth quarter of 2020; however, distributor respondents doing business primarily in the industrial pipe, valves and fittings channel continued to report declines.

Total ASA distributor respondents reported a median 1.4% sales growth for the full year 2020 vs. 2019, and inventory levels rose 4.9% in the fourth quarter of 2020 compared to the fourth quarter of 2019.

Bill Gray

This week, Mechanical Hub features Bill Gray, president, Uponor North America to get his company’s pulse for 2021. You get the sense that it’s time to move forward and the time is now to take full advantages of the opportunities that lie ahead.

MH: While putting together the Mechanical Hub annual forecast last year, you were one of the only ones to go on record who took COVID into account in the short-term up until that point in mid-January 2020. What were you hearing?

GRAY: We were starting to hear “noise” in the supply chains. You have to understand, I have a mother in the background who was reading all the articles, warning me about traveling to Europe and Hawaii. What sounds like wisdom from me is actually deriving from my mother yelling in the background to stay home.

MH: Most of the residential guys are doing fine, but there are hiccups with commercial and industrial sectors. What does the short-term economy look like for Uponor? What are the economic indicators telling you?

GRAY: This is a question we try to answer on a weekly or bi-weekly basis with our European parent company. We are currently enjoying a very healthy level of business. In 2020, we hit the brakes in April after a great first quarter. By the end of May, it was all back in a big way. All that demand that fell off, people decided to get that work done. Through Q3, it was good volume.

We knew there was more volume going into residential. For commercial, no one was stopping projects already coming out of the ground. I don’t know when we will see commercial projects begin to tail off. As you know, 12, 18, or 24 months is nothing to get a commercial project rolling. What I am told is that there are fewer projects to quote in commercial order books. Certain segments are more adversely impacted than others. For example, it is hard to imagine you are going to build a new hotel if you haven’t already broken ground.

I am one of those guys who normally spends 75 to 100 nights a year in a hotel. In 2020, I spent maybe 20, and all of those were at the beginning of the year. So that challenge to commercial will keep getting pushed forward. They will still need to perform retrofits, and that might open up some opportunities.

Residential is on fire, supported by demographic demand that has been held back. We often speak of “natural” household formations coming in at 1.5 million annually. We never achieved that level coming out of the past recession, so the demand gets pushed forward. Meanwhile, existing homes valued between $250,000 and $500,000 are going for the asking price or higher and don’t last very long at all on the market. Builders of new homes are building into their 2022 and 2023 land plans currently.

One of the factors that may bring down that activity is that builders cannot get land fast enough, as they burn up all of their lots now. So, we are in a window now, and everyone is building homes as fast as they can, and prices are slowly climbing. Input prices are crazy. Truss packages—nobody builds trusses on the job site anymore—are going for 3X or 4X vs. 2020 levels. Insulation deliveries are crazy; all the HVAC and mechanical stuff—crazy. Our friends over at Bradford White are at six to eight weeks currently.

There is demand out there. RWC just released their numbers, but had great sales growth last year with more exposure to DIY through Home Depot and Lowe’s. We know the latter pair are doing very well. We are seeing a lot of switch-in-spend right now. “I cannot go on vacation, so I am going to work on my house and yard.” Many cannot get a contractor to do the work, and if they do, the pricing can be very high. “I’m willing to take the work, but it will cost you.”

MH: As far as inventories and supply, how is Uponor faring?

GRAY: We shut down the plant for eight days in April and laid off some staff in distribution and manufacturing. We have them back, plus. We are up to a month behind right now against a strong order volume. We were famous for delivering our product on time and in full. The problem definitely relates more to residential—smaller-diameter pipe.

It is what it is right now, but I question how long this activity can be sustained. Most companies, from what I have read, are saying like the first half, maybe through Q3 2021. But there is no election this year. We will see what happens with the stimulus packages. Do they finally do something on infrastructure? We need infrastructure work—now is the time to do those projects. Money will never be cheaper, nor labor more plentiful. But if you wait until a full economy, the challenges will be much greater.

I think if the federal government plays this right, understanding the dynamics of the market today—like in 2008-09, shovel-ready projects that will keep the economy going—I think construction could be really good—or really challenging. A lot of variables have not played out yet.

MH: How are you steering the ship to deal with COVID? You have gotten through 2020, is it all systems go? Anything different?

GRAY: What we did as well as or better than anyone else—not just in our industry, but in other industries too—is that we got on top of the problem early with our COVID Task Force. Originally, we were focused on problems in the supply chain, but that transitioned very quickly to our employees’ health and safety, as COVID hit the United States. We started looking at where our employees were traveling for work, creating an awareness, telling them if you are going to an area that may be compromised, be sure you are taking the proper precautions for yourself and your colleagues.

We were able to keep the plants open, because we were designated—along with most of new-construction markets and building products—as essential services. We have been promoting health and safety first, then the continuity and integrity of our factories, making sure we are able to ship products to customers. That is how we cascaded these priorities.

At Uponor, we went virtual on Friday, March 13, 2020, with the idea that we should test our systems in case we must work from home at some point, and everything worked out well from an IT perspective. As it turned out, ironically, the mandate to work from home came down over that weekend.

Next, we did a live migration to Microsoft Teams, which was a huge improvement over our previous platform.

As the situation has “stabilized” now—as much as it can be stabilized—we are continuing monthly calls with all employees. The leadership team and I continually explore what’s new, what’s different? When can we expect to come back to the office? What’s coming back going to look like? We try to manage all that.

From my perspective, we won’t be coming back to anything normal probably until 2022. My boss from Finland visited the United States the week before the AHR Expo in 2020. I don’t expect to see him in the United States at all in 2021. It’s been spotty in that part of the world, although with their stronger central governments, they seem to have managed COVID more effectively. Their countries haven’t had the same levels of infection. My next trip to Europe may be Q1 of 2022. By then, I should have the vaccine, I am confident.

The big unknowns on the horizon are the variants of COVID and whether the vaccines will help prevent their spread. Or is our future more pandemics? I don’t know right now.

MH: Last month, Uponor launched its new Complete Polymer Solution for commercial-piping applications in the U.S. How do you manage a launch like this in the midst of a pandemic and the cancellation of a major trade show?

GRAY: We did a soft launch around the announcement of the relationship with Pestan at the AHR Expo in 2020. We understood the amount of work that lay in front of us. For a company like Uponor to launch a product line of this magnitude, it is a major endeavor.

Which is why I have such an appreciation for our team and their ability to pivot at every opportunity, figuring out just how we would get all the work done. We knew the objective; we knew the amount of work we had to do. But there was a tremendous amount of creativity to making it all happen. Working with our health and safety people, our team developed a protocol for how we would do all this work internally while maintaining proper social distancing.

Then, with the launch itself, there is a lot to going virtual. It may look like it’s going rather smoothly. But when you see the machine behind the people, and how it makes this all work, you can’t help but be impressed. I did my on-camera interview a couple of weeks ago, and at the time it feels like a disparate collection of takes and cuts. But they brought it all together through an editing process that makes even me look good. That’s a pretty tall order!

MH: The market for this PP-RCT launch right now: Is it targeted for domestic water as well?

GRAY: We believe the best opportunity is mechanical. Pursuing domestic water would fragment our efforts. If we focus on mechanical and get really good at that, we can start taking on plumbing. Plumbing is more complex than mechanical; there are different dynamics at play. We think this is the best strategy for us right now. If you are a small company without much of a brand, you can do a lot more across more markets without much risk. If Uponor puts its name on something, we want to make sure we have it right, so our customers are confident it will work.

That is part of the leverage we are providing. If Uponor is offering these products with the full bundle of support—the national rep network, our knowledgeable sales force, on-site training and technical support—the customer can feel better about getting involved. We just felt plumbing would fragment our efforts too much.

Bill Gray is president, Uponor North America.

Bill Gray is president, Uponor North America.