Rheem®, a leading global manufacturer of water heating and HVACR products, today announced that Chris Haynes, vice president of Global Procurement, has been named as a Supply & Demand Chain Executive “2023 Pros to Know” award recipient. The award recognizes outstanding executives whose accomplishments offer a roadmap for other leaders looking to leverage their supply chain Read more

water heating

Rheem®, a leading global manufacturer of water heating and HVACR products, today announced that Chris Haynes, vice president of Global Procurement, has been named as a Supply & Demand Chain Executive “2023 Pros to Know” award recipient. The award recognizes outstanding executives whose accomplishments offer a roadmap for other leaders looking to leverage their supply chain for competitive advantage.

As vice president of Global Procurement, Haynes oversees the global strategic sourcing across Rheem’s air and water divisions that include an array of products, such as tank-type and tankless water heaters, air conditioners, furnaces and HVAC systems for residential and commercial applications.

“I am honored to be chosen by my peers for the Pros to Know award and to be in the company of the other esteemed winners in my field,” said Haynes. “With the fast-paced world of supply chain becoming highly volatile in recent years, this is great recognition of Rheem’s unwavering commitment to deliver high-quality products for our customers. Today’s environment requires us to constantly reinvent what it means to be a supply chain professional and I’m incredibly proud to help lead Rheem’s global sustainability practices, which we have implemented rapidly on a large scale.”

“I am honored to be chosen by my peers for the Pros to Know award and to be in the company of the other esteemed winners in my field,” said Haynes. “With the fast-paced world of supply chain becoming highly volatile in recent years, this is great recognition of Rheem’s unwavering commitment to deliver high-quality products for our customers. Today’s environment requires us to constantly reinvent what it means to be a supply chain professional and I’m incredibly proud to help lead Rheem’s global sustainability practices, which we have implemented rapidly on a large scale.”

Haynes has had an illustrious career with Rheem spanning more than a decade. He manages a global team with 60 direct and 125 indirect reports across 25 locations in 10 countries. Haynes also is passionate about mentoring staff and investing in talent to build strong teams across Asia, Europe, Latin America and North America.

Facing global supply chain disruptions, post- COVID-19 recovery and inflation, Haynes always ensures Rheem can deliver outstanding results for its customers by spearheading and revolutionizing Rheem’s inbound supply chain process. Serving as a company leader on Rheem’s “A Greater Degree of Good” sustainability initiative, Haynes has worked with global suppliers and manufacturing facility leaders to reduce Rheem’s carbon footprint, utilize recycled materials and work toward achieving the zero waste to landfill goal.

“Chris is not only a ‘Pro to Know,’ he is one of Rheem’s supply chain heroes and sustainability champions,” said Rheem President Global Water, Rich Bendure. “Chris is customer-focused in everything he does and, as a leader, inspires his teams to put that into practice every day. Chris knows that exceeding our customers’ expectations, particularly in times of uncertainty, gives us a competitive advantage in the marketplace, and solidifies Rheem’s long-term reputation as a manufacturer that delivers on our commitments. Congratulations, Chris, on this much-deserved award.”

Visit https://www.sdcexec.com/awards/pros-to-know to view the full list of “Supply & Demand Chain Executive 2023 - “Pros to Know” winners and visit rheem.com to learn more about Rheem’s latest news.

AHR 2023 is a wrap, and the biggest U.S. HVAC show marks the 20th time—minus the COVID year—that I have attended this great event. A huge shoutout to the Stevens family for organizing such a great experience. Also, huge props to Nicole Bush and her press team for helping the trade press throughout the event Read more

AHR 2023 is a wrap, and the biggest U.S. HVAC show marks the 20th time—minus the COVID year—that I have attended this great event. A huge shoutout to the Stevens family for organizing such a great experience. Also, huge props to Nicole Bush and her press team for helping the trade press throughout the event, and keeping them fed and hydrated.

Now that we’re all back home safely—I hope—we can digest the event and gain a better perspective of what transpired over these past three days. The numbers haven’t been shared yet attendance-wise, but it was a hugely successful event, especially coming through what some call the “COVID years,” where traveling came to a stop—with more people now connecting again.

The MH team, and some old guy.

I would be remiss if I didn’t mention some of the manufacturers’ investment in after parties that are always a hit! For the Mechanical Hub crew, for example, it was Taco, Burnham/U.S. Boilers, Rheem, RLS, Franklin Electric, RIDGID and Viega.

From what I heard, over and over again, is that Atlanta just isn’t the most optimum place for a trade show, if I can be perfectly honest. Listen, Atlanta is a wonderful city with plenty to do and many fine places to eat and drink, but the traffic, and the infrastructure to support such a trade show, need to improve. But hey, it was 65 degrees and sunny, and relatively quick flight to the show. So, I suppose it does have its advantages. Where does Atlanta rank for you? Atlanta, Chicago, Orlando, Las Vegas. Perhaps it should be noted that the sooner you book accommodations for a show, the more strategically you will be for rides, dinners, walking, etc.

Nevertheless, I can’t tell you how many people sniped about the layout of the show floor—getting from one end of Exhibit Hall C, and its meeting rooms, to the other end of Exhibit Hall B, and its meeting rooms was a hike. My feet, and the 55,000 steps according my trusty Fitbit, were a testament to that.

Also, as I mentioned, 20 years of covering the event, it’s nice to see the changing of the guard with some young talent in attendance, more pointedly—and I know some don’t like to be referred to as this—social influencers. They cover the floor tirelessly to promote the show and new products. In fact, I was lucky enough to attend the social media breakout on the last day. Ten of the brightest influencers graced the stage to talk about their experiences and the importance of social media, and what it means to be an influencer.

HVAC & Social Media: Strengthening the Trade with a Community Mindset—from l to r: Ben Poole @hvactactical, Jamie Christensen @northwest_hvac, Aaron Bond @bond_aaron, Michael Flynn @flynnstone1, Jeff DeMassari @jeffjdemhvac, Jessica Bannister @hvacjess, Rachel Sylvain @hvacrara, Chris Stephens @hvacrvideos, Eric Aune @mechanicalhub, and last but not least, Omar Harris @omartheplumber.

We also were fortunate to share the stage with some of the best podcasters on the planet, as our Make Trades Great Again, hosted by Eric Aune and Andy Mickelson, featured three podcasts during show hours to much fanfare. Guests included representatives from RIDGID, NIBCO, Navien and guest Travis Albaire, T.A.P. Plumbing and Heating. Check them out wherever you stream. Also, the Appetite for Construction podcast, hosted by John Mesenbrink and Tim Ward, featured two podcasts, which featured guests from Bradford White, Rheem, Spirotherm, Lochinvar, and Danny G and Louie the Boiler Man. These recording will be launched within a couple of weeks. In the meantime, check out these podcasts wherever you like to stream stuff, or you can always find them right here on our site.

The Appetite for Construction Podcast with guests Louie Medina @louietheboilerman and Danny Gronendyke @howitbewithdannyg

The Make Trades Great Again Podcast with guests Michael Provenzano, director of pressing and Jim Vild, Atlanta territory manager, RIDGID.

As far as the latest and greatest, you couldn’t get far without seeing the future. Electrification, decarbonization, hydrogen technology are making waves as more heat pumps, electric furnaces, electric boilers, hybrid heat pumps and prefabbed distributed pumping methods are front and center; the latest in thermostats, and a plethora of other products that can talk to each other, and you, with a WiFi signal—from circulators, forced air furnaces to tankless water heaters. New or improved pipe joining methods through press technology, push-to-connect fittings, fusion welding, advances in pipe bending and cutting drew eyes. Listen, if it’s in the HVAC industry, it’s at AHR.

Check out Mechanical Hub websites, social media (@mechanicalhub & @plumbing_perspective on Instagram and TikTok, Facebook and LinkedIn.) and check out our ever-growing YouTube for products from the show.

Next year’s AHR Expo will take place in Chicago, my back yard, January 21-24 (2024). Again, check back for updates on the show or any other breaking announcements surrounding the event.

Stewart-Haas Racing’s Chase Briscoe along with Tony Stewart Racing’s Leah Pruett and Matt Hagan to Carry Rinnai Branding in 2023. Kannapolis, N.C. — Rinnai America Corporation has partnered with Tony Stewart and his racing entities in NASCAR and the NHRA to promote its line of products using his diverse motorsports portfolio. In NASCAR, fans will see the red Read more

Stewart-Haas Racing’s Chase Briscoe along with Tony Stewart Racing’s Leah Pruett and Matt Hagan to Carry Rinnai Branding in 2023.

Kannapolis, N.C. — Rinnai America Corporation has partnered with Tony Stewart and his racing entities in NASCAR and the NHRA to promote its line of products using his diverse motorsports portfolio.

In NASCAR, fans will see the red Rinnai logo in an associate position on Stewart-Haas Racing’s No. 14 Ford Mustang driven by Chase Briscoe in the NASCAR Cup Series. In the NHRA, Tony Stewart Racing drivers Leah Pruett and Matt Hagan will carry the Rinnai logo in the Camping World Drag Racing Series, with Pruett running a full Rinnai primary sponsorship on her Top Fuel dragster in two events – the NHRA Winternationals March 30-April 2 in Pomona, California, and the NHRA Carolina Nationals Sept. 22-24 in Charlotte, North Carolina. Hagan will sport a full Rinnai livery on his Funny Car in the NHRA New England Nationals June 2-4 in Epping, New Hampshire, an event the three-time champion has won four times, including in 2022.

“Our expertise in tankless water heating is unmatched, and this partnership with Tony Stewart and his NASCAR and NHRA teams allows us to tell that story in a thrilling, team-oriented environment that emulates the quality and dedication we put into our products and services,” said Frank Windsor, president, Rinnai America Corporation.

“The similarities of our business to racing are numerous especially when speed efficiency, and superior quality are keys to success. Performance is paramount, and that’s something Rinnai has always understood. It’s part of our overall commitment to our customers, and racing embodies that commitment.”

The NASCAR Cup Series encompasses a total of 39 events in its milestone 75th season, beginning with the non-points Busch Light Clash Feb. 5 at the Los Angeles Memorial Coliseum and ending with the season finale Nov. 5 at Phoenix Raceway. The NHRA Camping World Drag Racing Series includes 21 events in 2023. Its 72nd season starts with the NHRA Gatornationals March 9-12 in Gainesville, Florida, and concludes with the NHRA Finals Nov. 9-12 in Pomona.

“We’re incredibly proud to have this partnership with Rinnai because it shows the strength of our motorsports program,” Stewart said. “NASCAR and NHRA offer two very different fan experiences and combined they touch every corner of the country. Rinnai and its customers get the best of both worlds because our program allows a number of choices to promote its products and services.”

In addition to branding on racecars, Rinnai becomes the official tankless water heater of Stewart Haas Racing and Tony Stewart Racing. This designation highlights Rinnai’s brand promise of “Creating a healthier way of living®”, a mantra that is at the forefront of all the company’s efforts. By continuing to offer quality products and services to homeowners and organizations, Rinnai is aiding in providing businesses and homes with energy-efficient hot water options for cleaner and healthier living.

The announcement of the partnership comes after a series of milestone events for Rinnai America. “We opened a new manufacturing facility last year in Griffin, Georgia, that has allowed us to combat shipping delays and supply-chain challenges. In this facility, we manufacture our new RE Series™ Tankless Water Heater, the first and only non-condensing unit with a built-in pump. That product, along with our ability to manufacture in the United States, is another reason why we’ve partnered with Tony Stewart and have become the official tankless water heater of Stewart Haas Racing and Tony Stewart Racing,” Windsor said.

Increase in demand for steam boilers from several end-use industries and surge in investment toward adding power generation capacity have boosted the growth of the global steam boiler market. Portland, Ore. — Allied Market Research recently published a report, titled, “Steam Boiler Market by Type (Water Tube Boiler and Fire Tube Boiler), Fuel Type (Coal Fired Read more

Increase in demand for steam boilers from several end-use industries and surge in investment toward adding power generation capacity have boosted the growth of the global steam boiler market.

Portland, Ore. — Allied Market Research recently published a report, titled, “Steam Boiler Market by Type (Water Tube Boiler and Fire Tube Boiler), Fuel Type (Coal Fired, Oil Fired, Gas Fired, and Others), Pressure (Low Pressure and High Pressure), and End-Use Industry (Power Generation, Oil & Gas, Chemical, and Others): Global Opportunity Analysis and Industry Forecast, 2020–2027″. As per the report, the global steam boiler industry was accounted for $15.6 billion in 2019, and is projected to reach $20.0 billion by 2027, growing at a CAGR of 3.3% from 2020 to 2027.

Drivers, restraints, and opportunities

Increase in demand for steam boilers from several end-use industries and surge in investment toward adding power generation capacity have boosted the growth of the global steam boiler market. However, implementation of strict government regulations toward environmental pollution and high initial cost and development in the renewable energy sector hinder the market growth. On the contrary, advancements in technology and upgradation of aging power generation infrastructure are expected to open lucrative opportunities for the market players in the future.

Covid-19 scenario:

- The Covid-19 pandemic and followed lockdown resulted in temporary ban on import & export and hampered the manufacturing & processing activities across various industries. This reduced the demand for electricity from end-user industries.

- However, the demand for steam boilers is expected to rise as the need for electricity has increased in the first quarter of 2021 from individual and commercial customers.

The gas fired segment to manifest the highest CAGR through 2027

By fuel type, the gas fired segment is estimated to register the highest CAGR of 3.6% during the forecast period, due to rise in awareness and stringent government regulations towards low emission fuels. However, the coal fired segment held the lion’s share in 2019, accounting for nearly two-thirds of the global steam boiler market, owing to rise in demand for coal fired steam boilers from the various end-use industries including power, food processing, cement, sugar, and steel.

The chemical segment held the largest share

By end-use industry, the chemical segment dominated in 2019, holding nearly half of the global steam boiler market, due to rise in demand for steam boilers from the chemical processing applications ranging from heating fluids to driving equipment. However, the power generation segment is expected to portray the highest CAGR of 3.5% during the forecast period, owing to increase in electricity demand from the various customers ranging from individual residential customers to industrial customers across the globe.

North America dominated the market

By region, the market across North America held the largest share in 2019, contributing to more than one-third of the market, due to increase in demand for steam boilers from large-scale industries such as mining, power, healthcare, commercial, manufacturing, and data centers. However, the global steam boiler market across Asia-Pacific is projected the highest CAGR of 3.6% during the forecast period, owing to large number of key players and availability of the manufacturing facilities in these countries.

Major market players

- General Electric

- IHI Corporation

- Babcock & Wilcox Enterprises, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Forbes Marshall

- Alfa Laval AB

- Viessmann Limited

- Hurst Boiler & Welding, Inc.

- Thyssenkrup

- Thermax Limited

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.”

It’s that time of year again where media, prognosticators and media prognosticators try to look into the immediate future to predict, and make sense of, the short-term economy. And, yes, even in this uncertain climate. According to the Air-Conditioning, Heating & Refrigeration Institute (AHRI), U.S. shipments of residential gas storage water heaters for January 2021 Read more

It’s that time of year again where media, prognosticators and media prognosticators try to look into the immediate future to predict, and make sense of, the short-term economy. And, yes, even in this uncertain climate.

According to the Air-Conditioning, Heating & Refrigeration Institute (AHRI), U.S. shipments of residential gas storage water heaters for January 2021 increased 3.4 percent to 397,342 units, up from 384,213 units shipped in January 2020. Residential electric storage water heater shipment saw a 2.4 percent increase in January 2021 to 395,640 units, up from 386,291 units shipped in January 2020.

Commercial gas storage water heater shipments decreased 7.8 percent in January 2021 to 6,642 units, down from 7,207 units shipped in January 2020. Commercial electric storage water heater shipments decreased 7 percent in January 2021 to 11,737 units, down from 12,626 units shipped in January 2020.

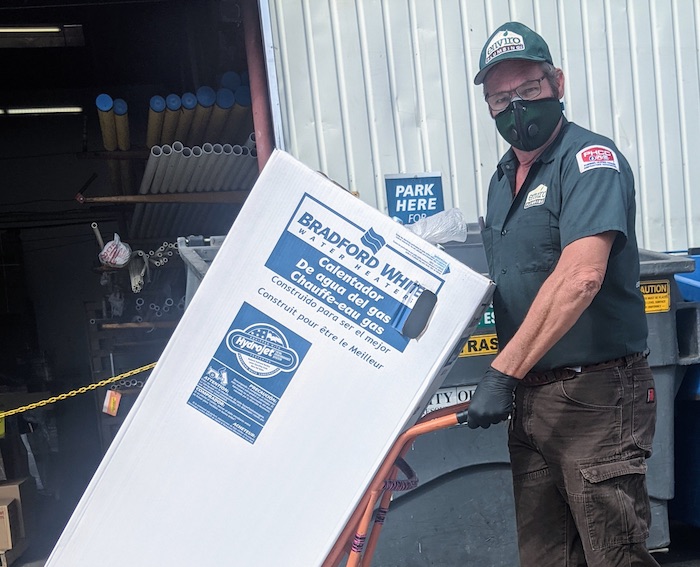

Having said all of that, Mechanical Hub decided to go right to the source to get an up-close sense of how the market is faring. We continue our Forecast Series with Bruce Carnevale, president & CEO, Bradford White.

Having said all of that, Mechanical Hub decided to go right to the source to get an up-close sense of how the market is faring. We continue our Forecast Series with Bruce Carnevale, president & CEO, Bradford White.

MH: When it comes to 2021 industry forecasts, the most resonant word I hear is optimistic. That word can become hollow if it doesn’t have any substance backing it up. I’ve read reports that residential service repair and remodel may remain constant with a slight increase in early 2021. What does the short-term economy look like as it relates to BW?

CARNEVALE: In a word, challenging. While demand for our core residential products remains strong, material and labor costs have risen substantially. Labor availability for manufacturers is still a significant problem and has been exacerbated by COVID-19 complications and government policies. Steel prices are at or near all time highs, and supply is becoming an issue for some manufacturers. These factors lead to longer lead times, higher prices to the end user, and product shortages.

We know intuitively that the “nesting” effect has led to increased demand because household appliances are being use much more that they normally would be. There is no good data on magnitude of the increased demand, nor how long it will last.

Commercial demand has recovered slightly, but with commercial businesses still in some state of shutdown in much of the country, we don’t see that segment starting to recover until the second half of 2021. It is unlikely that the commercial segment will fully recover to pre-pandemic levels until after 2022 because so many businesses will permanently shut down as a result of the pandemic-forced shutdowns.

MH: What are some indicators you look at to determine trends, movements, etc.?

MH: What are some indicators you look at to determine trends, movements, etc.?

CARNEVALE: We look at traditional indicators such as housing starts re-sales, mortgage rates, CPI, consumer confidence, manufacturing output and inventories, unemployment rates, etc. Several years ago, we incorporated student loan debt into our analyses since it has such a significant impact on first time homebuyers. Additionally, we closely follow regulations and all levels and social preferences to determine their impact on product trends.

MH: I read somewhere that at the rate the U.S. is distributing the vaccine, we should be back to “normal” by 2024. Perhaps that’s a bit overly dramatic, but how does (has) BW positioned itself from the “fallout” of COVID-19?

The honest answer is that nobody really knows when we will be back to normal. Even after we are, there will be lasting effects from the pandemic. We are following the data and trends closely and adjusting our strategy accordingly. We expect some pre-pandemic trends to change significantly. For example, the trend toward urbanization will change as more people are able to work from home. This leads us to believe that the housing new construction will shift away from multifamily towards single family as people can move further out from cities.

Additionally, we are solidifying supply chain and strengthening our contingency plans, further developing our own work force, and investing significantly in R&D to bring relevant, innovative products to the post-pandemic market.

MH: Is the only certainty heading into early 2021 uncertainty? How do you forecast and budget for such uncertainty? (Or is it fairly certain at this point during the pandemic?)

CARNEVALE: Uncertainty has made forecasting for 2021 is as much art as it is science. We used an immense amount of data, both historical and forward-looking, and applied significantly more assumptions than we typically would. We also included insights derived from some original research projects we commissioned.

MH: Without getting overly political, does a change at the presidential level (and congress) change the outlook for your company, if at all? (Infrastructure, regulations, green energy initiatives, etc.)

CARNEVALE: Yes. It is no secret that the Biden administration will have a very different policy positions than the Trump administration. Some of the expected changes may be helpful, and others will present challenges. Infrastructure legislation, for example, will be good for our industry. We know there will be a focus on green energy initiatives, and that too can be good for our industry if they are thoughtfully applied. The regulatory environment will become more challenging, but we are hopeful that the new administration will partner with manufacturers in developing new regulations.